Discover unlimited possibilities

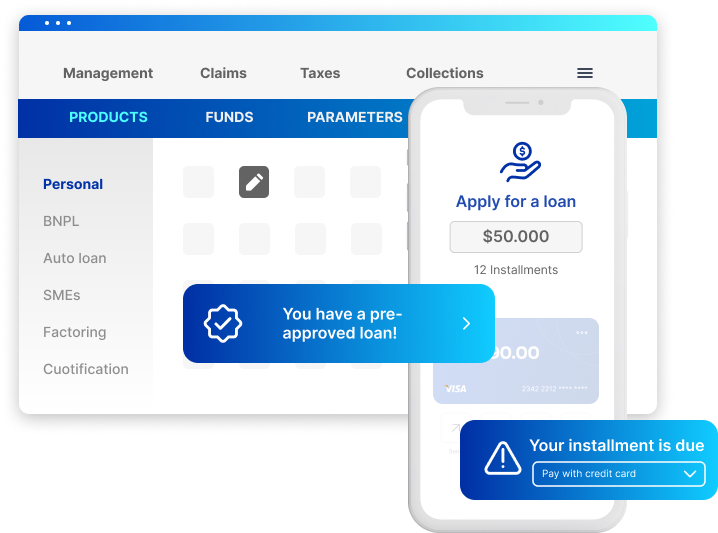

Comprehensive management of multi-product accounts. 360 vision, history, and management of all interactions.

Configurable status, rules, and actions.

Complete flow, from onboarding to collections CRM.

Code-free configuration of rates, promotions, points, frequencies, conditions, taxes, among others.

Discover the power and versatility of our Core

Back Office Module

Configuración Module

Guarantees the autonomy, agility, and adaptability of your operations.

Multi-country

Accounting, tax tables, compliance, and local integrations throughout LatAm.

Multi-entity

Manage multiple branches or merchants under the same platform

Multi-product

Manage all your products with independent parameters.

Multi-platform

Impact each flow from web, mobile, or tablet.

Interact with the core directly or consume services via API.

Unique vision

Put your customer at the center, with an integrated view of all their products and operations.

Integrations

Gain agility with a 100% API & Cloud solution.

Offer installments with embedded finance

Choose a proven model

B

Banks

Finance the end customer

Expand their network at no cost to local businesses

Strengthen commercial partnerships

2

B

Retailers and Merchants

Join in days

Increase their sales

Build customer loyalty

2

C

Consumers

Improve access to products and services

Get credit in minutes

Only need their ID

Get more information about LENDING BNPL

Create and manage accounts receivable financing operations

Generate a Factoring & Confirming ecosystem

Factoring

Supplier uploads invoice for receivables

Institutions compete to purchase the invoice

Institution X wins the factoring, the sale is completed

Confirming

Client company uploads invoices for payables

Bank offers advances to suppliers

If the supplier accepts, they are financed

Provide collection tools to the Factor

Issuer and Payer already registered as credit subjects

COLLECTIONS Solution

Traceability

Intervening scoring updates

Monitoring, alerts, reporting

Implement the complete flow for each use case

From Onboarding to Collections

Origination

Biometrics

Decision Engine

Core

Middleware & Scheduler

App

Collections

Reporting

BNPL

Banks

Quantify the products you sell.

In minutes, only with an ID

Bank + Retailer

Partnership

Retailer: Increase sales

Bank: Finance

Financial Institutions

Get a 100% digital channel for your current credit proposal

Producer + Distributor

Partnership

Distributor: Increase sales

Producer: Finance and increase sales

Employee Loans

Build loyalty and enhance your proposition as an employer brand

Student Loans

Loans for students

Get more information about LENDING Factory

The end-to-end solution chosen by leading brands

End-to-end Solution

Prospecting, simulations, pre-approvals

Biometric validation

Automated credit assessment

KYC/KYB (validations)

Segmented payment plans

Digital signature

Collections and portfolio sales

Monitoring, reporting, and alerts

Scope

Offering of automotive loans and leasing. Sale and financing of tracking accessories and services

B2B, B2C (e.g., dealerships, self-service, others)

Multi-device, multi-profile

Operation in different countries simultaneously

Integrations

Dealership with financial institutions and banks

Credit bureaus

Brokers and insurance companies (cross-selling)

Digital Signature Providers

Local public entities

Benefits

Automation of offers

Higher approval rates and lower risk of uncollectibility

Dedicated risk team

Reduction of manual tasks

MVP in weeks

Flexible pricing

Get more information about Automotive LENDING

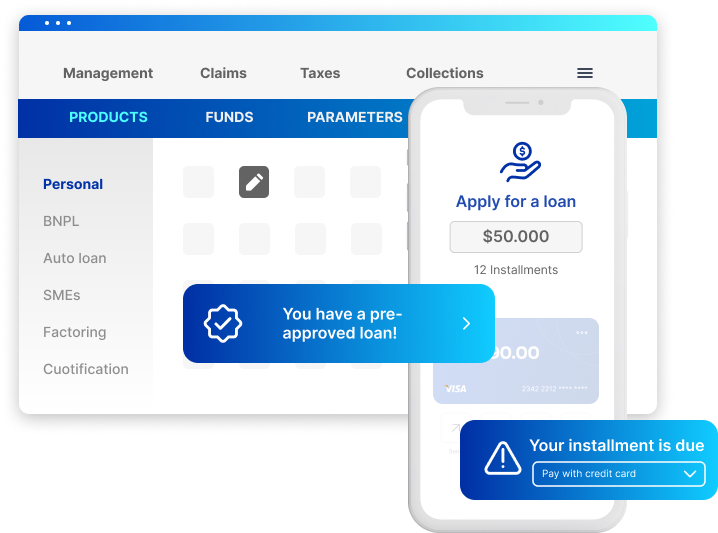

Personal loans and microloans made faster

Digitize and automate the entire cycle, from origination to collection

Renew credits based on business rules, without reloading information

Provide product financing instantly.

Expand your channels. Define hyper-personalized business rules and deploy them in real-time

Implement any repayment system: French, German, American, with bonus payments for good behavior, grace periods, customized.

Easily integrate with all credit bureaus and institutions.

Incorporate the best market practices, with expert consultancy from consultants at LatAm level in risk and collections.

Get more information about LENDING

Get to know the products behind our LENDING solution

A white-label mobile front for credit, product, and payment management.

Available on iOS & Android.

Enables digital onboarding, identity validation processes, and biometrics.

Multi-device workflow for customer and product originations.

Allows you to manage the complete origination: request reception, preliminary evaluation, credit analysis, verification, validation, approval, conditions, and disbursement.

Decision, risk, and scoring engine, with real-time impact.

Allows you to define business rules and automate decisions.

Multi-country, multi-entity, multi-merchant, multi-product, and multi-currency core.

Centrally manages loans, along with other financial products.

Provides a Back Office for user management, operations, and monitoring.

Manages accounts, payments, refinancing, and accounting.

Task scheduler that automates processes and manages interfaces.

- Allows you to extract data from repositories.

- Manages and validates input and output information.

- Updates records.

Link between operating systems and databases with Apps and services. 100% Cloud via APIs.

Provides an additional layer of security.

Simplifies integrations with platforms and payment methods (BNPL, QR, Payment Link), validation services (bureau, phone, mail), and collections input systems.

Accelerates Time to Market and facilitates the incorporation of changes and functionalities.

Ensures that a possible failure does not affect other applications or systems.

Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) product.

Allows you to meet all anti-laundering requirements and prevent terrorism financing.

Integrates KYC/KYB validation processes.

Integrates queries to Terrorist Lists.

Fully navigable and flexible report and dashboard manager, with real-time updates.

Allows you to evaluate campaign performance.

Generates reports by role and profile type, by product type, and by portfolio.

Allows access to all historical data.

Pillars of our technology

IA

LOW CODE

API & CLOUD

OMNICHANNEL

2022

They provided excellent responsiveness to our new requirements and gneral support. The tool is very versatile, allowing non-expert areas in Systems to make policy changes easily.

Project Director

The human quality accompanied by the professionalism and knowledge of their collaborators have been fundamental to assume the proposed challenges and achieve the expected results by the organization.

2023

Even when the system is flexible enough, we've requested changes and they were implemented promptly. The tool defines the required inputs, it is quite dynamic and independent.

Risk Manager

We totally recommend this solution. The implementation process was simple and intuitive, with a full API integration. The solution is flexible, scalable and stable: we've been working for more than 6 years without problems or crashes.