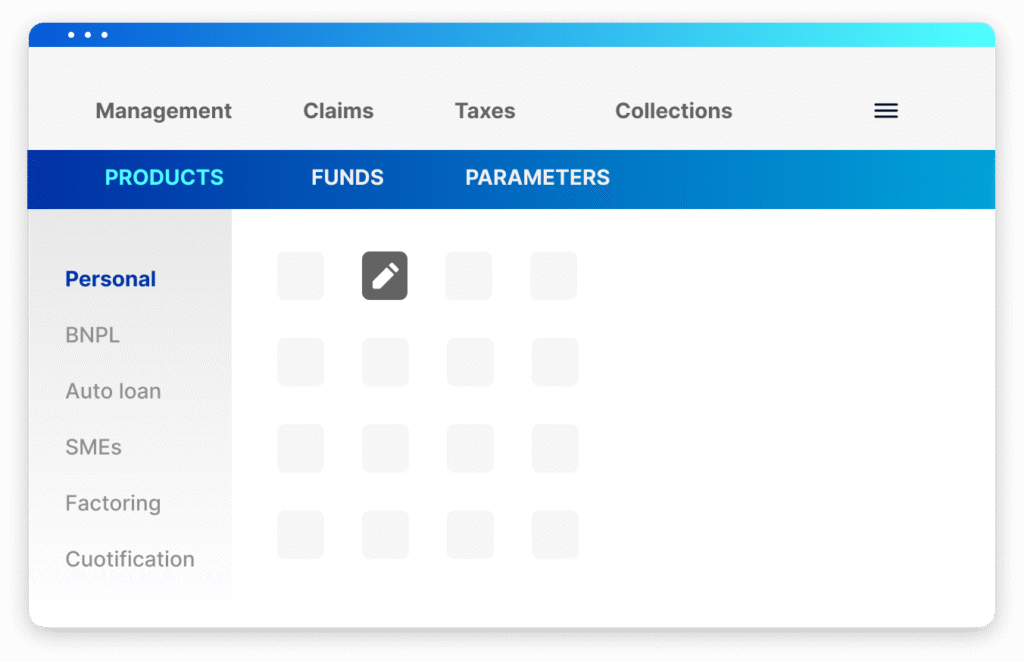

Build your ideal loan product

Design your ideal product by configuring 200+ variables and control the entire lifecycle in one place.

Onboarding

Multiplatform solution for client and loan origination.

Payment Channels

Cash, cards, bank transfers, and bulk processing.

Scoring

Risk models adapted by geography and customer segment.

Collections

Agent portal, automated notifications, and behavior-based segmentation.

Administration

Customer and operations management. Back office, dashboards, and accounting.

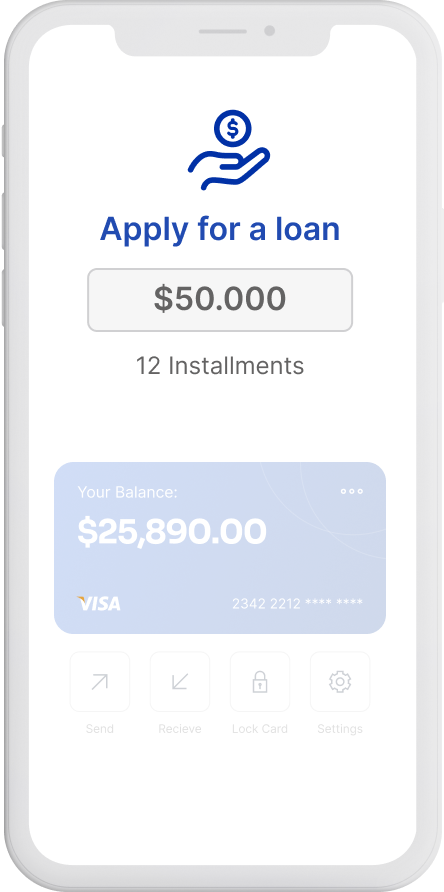

App

White-label solution with end-to-end UX for digital lending.

Lending Factory

Go live in three simple steps.

A turnkey solution for the complete workflow. Deploy in days with minimal investment.

1

Discovery

Parameter-configuration form

2

Data Onboarding

Setup using the defined parameters

3

Client Testing

Customer training and go-live testing

Automotive Lending

The end-to-end solution chosen by industry leaders

Offer secured loans and leasing for B2B/B2C (dealerships, self-managed programs, and more).

Operate simultaneously across multiple countries with a multi-device, multi-role platform.

Include accessory sales and financing, plus integrated tracking services.

Integrations

Dealerships with banks and financial institutions

Credit bureaus

Brokers and insurance companies (cross-selling)

Digital signature providers

Local public entities

Benefits

Automated offer generation

Higher approval rates, lower delinquencies

Dedicated risk team

MVP up and running in weeks

Flexible pricing

Lending BNPL

Offer installments with embedded finance

Choose a proven model

Banks

Finance the end customer

Expand their network at no cost to local businesses

Strengthen commercial partnerships

Retailers and Merchants

Join in days

Increase their sales

Build customer loyalty

Consumers

Improve access to products and services

Get credit in minutes

Only need their ID

Pillars of our technology

LOW CODE

API & CLOUD

IA

OMNICHANNEL

2022

They provided excellent responsiveness to our new requirements and gneral support. The tool is very versatile, allowing non-expert areas in Systems to make policy changes easily.

Project Director

The human quality accompanied by the professionalism and knowledge of their collaborators have been fundamental to assume the proposed challenges and achieve the expected results by the organization.

2023

Even when the system is flexible enough, we've requested changes and they were implemented promptly. The tool defines the required inputs, it is quite dynamic and independent.

Risk Manager

We totally recommend this solution. The implementation process was simple and intuitive, with a full API integration. The solution is flexible, scalable and stable: we've been working for more than 6 years without problems or crashes.